Popco’s fasteners in the service of art

mylar, music & a whole lot of fasteners Since Popco specializes in point-of-purchase display parts, our products are typically used to drum up sales in retail settings. However, much to our delight, our customers occasionally have less commercial and more purely...

Popco’s new GruVbanner Pocket Tube

end caps galore for maximum flexibility Popco has just launched the GruVbanner Pocket Tube, a lightweight and cost-effective alternative to wooden dowels and metal rods. The tube is 3/4 of an inch in diameter and is meant to be used in 1-inch banner pockets. Two...

Popco’s approach to artificial intelligence

our boomer/gen-x rant Full disclosure: Popco is run by a bunch of codgers. There’s nary a millennial in the bunch, let alone Gen Zers and so on. Imagine our surprise when we learned that AI meant artificial intelligence. We thought it meant: Atrociously Insulting....

Popco’s snazzy hardware for hanging in style

form, function & elegance Among our extensive line of sign-hanging rails, Popco’s top-of-the line offering is the aluminum Snaprail™ kit. This kit is a collection of products designed to grip sign stocks up to 0.07-inches thick and create a means of hanging signs,...

Popco can help when push comes to shove

we've got your back There are no trained economists at Popco. No specialists in geopolitcal analysis, either. We’re just purveyors of widgets that help keep the point-of-purchase industry humming along. As such, you’ll hear no pontificating from Popco. We’ll just say...

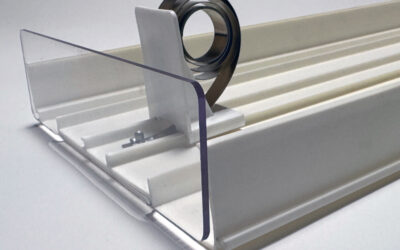

What do you do with that thing?

hmmm, it's hard to tell When you’re in the widget business, a common problem is that your products are not always self-explanatory. Useful items, shown out of context, can be truly baffling. Take for example the part shown here. Who could be blamed for not having a...

You will come rejoicing ringing in with pliers!

for loose-leaf binding & more Book rings, binder rings, snap rings — folks in the know...

Popco’s product pushers: one size DOES NOT fit all

for visibility and accessibility In grocery store coolers and freezers, and on store shelves,...

It’s that joyous time again!

Geez, another year has passed in a blink and here we are again, in the midst of the holiday...

Fly your flag on shelves with Popco

marketing ongondola shelves Gondola shelves, also known as Lozier shelves, are ubiquitous in...

Hanging with Popco on the holidays

Fall is here and so too are holiday promotions. During this busy time, Popco’s sign hanging rails...

Popco’s new catalog is hot off the press

Popco's 24th catalog is hot off the press and mailing now to our customers. In the new catalog, we...

Good things in small packages

It’s true, most of us like big things – big bank-account balances, big groups of friends, big...

The award to best supporting actor goes to…

Think of your point-of-purchase marketing piece as the star of the show. Now consider that a star...

Seeking attention? Waive your flag!

Let’s face it, we live in a shouty world. Retailers know this; they have no choice but to shout...

Mirror mirror on the door…

Mirror mirror on the door, make that shopper buy some more. That’s the point of this clever little...

Popco at Shop Marketplace: A smash success!

hello Cincinnati... On Tuesday, April 9, two Popconians landed at the CVG airport in northeastern...

Popco rocks the Shop! Marketplace show

Hello Cincinnati! Popco is on the road and ready to rock the 2024 Shop! Marketplace trade show....